What is the cost of late payment of a communication bill? If you think it’s just a few euros in interest after a few months, you’re mistaken. When you need a bigger loan, later on, it can translate into higher interest. And even a percentage point higher interest on a mortgage or car loan can add up to a much more significant amount over the lifetime of that overdue bill.

Our credit history is the “black box” of our financial responsibility, where information about our performance is stored for ten years. Good credit history is therefore essential when preparing to make various purchases with a loan.

The main things that can determine your personal credit history and the financing terms offered are:

Good compliance with existing commitments (payment of installments on hire purchase purchases, repayment of credit limit used and interest on credit card limit used, timely payment of mortgage or consumer loan installments);

Timely payment of bills for communication, TV, and utility services;

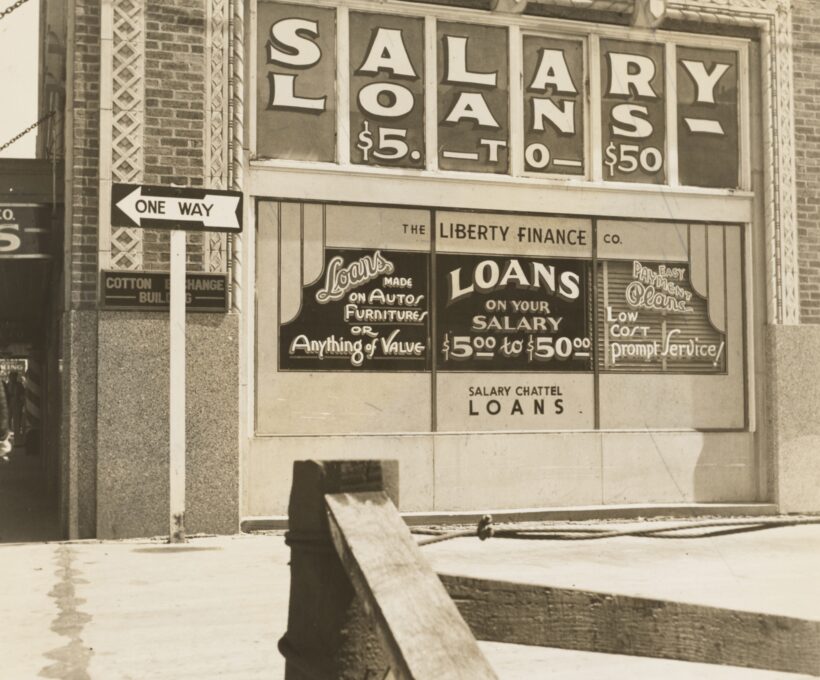

Responsible use of fast credit and, better still, avoiding it;

Financial discipline (spending within income limits, setting aside money for savings and investments).Knowing what is reflected in your credit history and what can damage it will help you make sound financial decisions that you are likely to thank yourself. What do we usually not know about our credit history, and how can it affect our ability to borrow?

Myth 1: Credit history is only essential for those who have loans.

It is a misconception that credit history is only relevant for people who already have a loan. In general, it is most suitable for those who are still considering borrowing, for example, for large and important purchases such as a home of their own, as it is one of the assessed criteria before granting a loan.

This will help you take care your credit history from the beginning of your financially independent life, as credit history is built up and stored for years. Late payments can catch up with you even when you have a permanent job and plan to buy a home. The less bad thing that can happen when you have a spotty credit history is a higher cost of credit or a lower amount of credit that the bank will agree to grant. If you have more serious offenses in your credit history, you may not get the loan you want at all.

It is important to remember that credit history is linked to a person, not to their credit or the financial institution that granted it. Once debts or arrears have been repaid, the credit history is not erased and does not disappear anywhere.

Myth 2: Banks are not interested in my unpaid phone bills.

Financial institutions and companies such as telecom and utility providers and some other legal entities pass on information about their customers to Creditinfo Lietuva. This credit bureau manages joint data systems. Therefore, information on the overdue period for paying debt on, for example, a telephone bill, will impact the credibility of the person and the risk taken by the financial institution in providing financing services to him.

Avoid overdue payments for communication or utility bills, not least because it may affect your future borrowing capacity and terms. If you are too far behind in your expenses, you may find your communication services limited or cut off, and the debts you accumulate may be even harder to pay later.

By the way, hire purchase services are also considered credit, just like any other loan from a bank or other company. It is both a financial commitment (which is taken into account when assessing the availability of another loan) and a risk of damage to the credit history through late repayment.

Myth 3: If I have even one credit record, I will no longer get a loan.

One entry in your credit history can also mean that a previous loan has been repaid or that your mobile phone provider checked your credit history when signing a contract with you. These kinds of entries do not harm your credit history. However, a person with a history of default is considered less trustworthy and riskier. This can make it more expensive and difficult for them to borrow.

Your credit history reflects your financial obligations, outstanding debts, and payment history. It will also contain information on inquiries made by various creditors (banks, leasing companies, telecommunication companies, etc.) to find out about your solvency. Your credit history also includes information on your involvement in the management of business entities.

Myth 4: A few euros not repaid on time will not cause any problems.

It is important to remember that late payment interest is almost always charged on overdue payments, which only increases the amount owed. So a small amount can turn into a bigger problem in a short time. Debt due by more than 90 days is the threshold at which a person is considered to be in default, and this information is also recorded in the credit history.

This information is stored and accessible to other legal entities for years. If someone applies for a loan and it turns out that they have defaulted more than 90 days even on several occasions, the institution may either refuse to grant credit or grant it on less favorable terms (with a higher cost of credit, a lower amount, etc.).

Myth 5: I can refuse to let the bank know my credit history, and no one will know about it.

Financial institutions only check the personal information, including credit history, in data systems with the customer’s written consent. However, this information is necessary before credit is granted.

It is essential to understand that your financial capacity and discipline are not only checked for the financial institution to reduce its risk of granting a loan that you may have difficulty repaying. An objective assessment of your financial standing and discipline is crucial for you and your economic well-being.

However, the fear of the bank finding out about your credit history will not exist if you manage your finances sustainably and responsibly. To temper your financial habits, you should start by analyzing your spending, making a savings or investment plan, and sticking to it.

At first it won’t be easy, but after a few months, it will become routine. In addition, if you are going to borrow a more significant amount, it may be helpful to set some time previously to cover future loan repayments. This way, you can better assess what you will need to give up to meet your future financial obligations.

Myth 6: Using a credit card has no impact on your credit history.

Credit card usage and interest payments are reflected in your credit history but can be harmful if you do not pay the interest on time. If the credit limit is actively used, the interest is delivered on time, and the loan is paid on time. Without delay, it shows to the bank that customers can be responsible and responsible with their commitments.

A good credit history (existing credit products and no recorded arrears) is preferable to no credit history, which may be more conservative because the bank does not know how the commitment will be handled.

Myth 7: If I have a bad credit history with one bank, I will apply to another bank.

Financial institutions share information about their customers. In addition, all banks operating in Lithuania are obliged to provide information on borrowers to the Bank of Lithuania’s loan risk database. These systems allow banks to check whether their customers owe other banks and assess borrowers’ existing liabilities.

All financial institutions share information, so you can’t run or hide from your bad credit history. Remember that this is also your protection against financial obligations that you may find challenging to meet if you already have a bad credit history with one financial institution and have the intention to take on financial commitments with another.

Myth 8. A record of late payment in your credit history occurs when you are more than 90 days late.

If a person is more than 90 days late in making payments to financial institutions, they are considered the default. At that time, the Bank of Lithuania’s Loan Risk Database shows the overdue payment from the first day of the due payment.

However, the institutions usually inform the person in one form or another about the debt. Therefore, it is crucial to provide accurate and correct contact details to the institutions with which you are in contact and update them if necessary. This way, if you accidentally forget to make a payment, the financial institution or other company to which you are obliged to make payments can remind you of the debt before it becomes part of your credit history.

How do I pay my bills on time? Today, many service providers offer e-bills that can be paid automatically. Anyone can simply sign up for an e-bill through your internet bank. Once you have done so, your bills will be received and paid automatically on a set day of the month. This way, not only will you not forget to pay your bills, but you won’t have to take the time to look at all your suppliers’ bills.

In cases where the service provider cannot offer an e-invoice, you can set up a recurring payment.

Automatic payment

Finally, if you cannot pay your bills at the end of the month because there is not enough money in your account, you should adjust your behavior. Try to pay all your bills at the beginning of the month or when you receive your salary. Spend money on other purchases after paying all your bills for the month or fulfilling other obligations. Suppose the due date of your repayments under your credit agreements is significantly different from the day you receive your salary. In that case, it is advisable to change the due date of your repayments.

Myth No. 9. My credit history has no relevance to my spouse.

Marriage vows are about sharing joys and sorrows, and financial obligations are about sharing both assets and debts. When a family is formed and a home loan is applied for financial institutions, the spouses must become co-borrowers or co-borrowers and guarantors unless they have signed a prenuptial agreement containing clauses. In this case, the joint solvency of the family and the credit histories of both borrowers are checked and assessed.

A spouse’s bad credit history may not be detrimental when hiring a purchase or a small consumer loan. However, for a larger loan, such as a mortgage, a spouse’s bad credit history may be a reason for denying a loan or other services to the family and may worsen credit conditions.

There are situations where the credit histories of both members of an unmarried couple are also assessed. In consumer credit, the other half of an unmarried couple is considered when the partners apply for credit together. Co-borrowing is usually necessary when a larger amount is desired and one partner’s income is insufficient.

In the case of unmarried partners applying for housing or other real estate financing and wishing to obtain a joint loan (including ownership of the real estate purchased), the credit history of the other half is also assessed.

Myth 10. Credit history can be repaired. Particular agencies do this.

Personal credit history data in Lithuania is collected and administered by the credit bureau Creditinfo Lietuva and is also available in the Bank of Lithuania’s Loan Risk Database. Under certain conditions, Lithuanians can find out for free their 10-year history of overdue debts, their existing debts, and which companies have been interested in their credit history in the last two years. For further information just by logging in to Manocreditinfo.lt, a personal credit history system.

However, the company does not “repair” credit histories. The best medicine, especially as a preventive measure, is responsible financial behavior, i.e., timely and proper payment of the required amounts. The information available covers the last ten years, so it is impossible to correct a decade of financial mistakes that have affected credit history. Advertisements in the public domain can sometimes be found offering to “repair” (for a fee, sometimes quite substantial, which must be paid in advance) a credit history. However, no official service does this, so such offers are just a scam to extort money from the public.

If you need bank loans in the future or think you may need to do so, check your credit history periodically. You may feel that you are sufficiently financially disciplined, but you underestimate everything, and your credit history is already sending warning signals. This periodic checking of your credit history can help you spot poor financial behavior and avoid more significant problems.

What if you want to keep your credit history “healthy” but have run out of money?

In such situations, the first thing that can help is the recommendation to have a financial reserve of 3-6 months’ income. If a car breakdown, a more expensive household appliance, or a medical emergency, having such a reserve will be the easiest way out. It’s like a personal insurance policy with no extra cost.

In each of these cases, you should look carefully at the borrowing conditions and pay attention to the total cost of consumer credit and its annual percentage rate (TCCAR). This is the best way to compare how much a given financing solution will cost.

However, if you have already decided to borrow, remember all the ten credit history myths and tips, pay your loan installments on time, don’t be late with installment payments on hire purchase purchases, and try to pay your credit card limit on time.